- #IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT PRO#

- #IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT SOFTWARE#

- #IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT PLUS#

- #IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT DOWNLOAD#

#IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT PRO#

This year, one of the significant changes comes with the end of the software's stand-alone QuickBooks Pro and Premier versions.

#IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT PLUS#

Very soon, QuickBooks ProAdvisors (for Desktop), Enterprise Users, and QuickBooks Pro/Premier Plus subscribers will be notified concerning the availability of the initial release. If you have questions you can always contact me.Intuit has just announced the release of the QuickBooks Desktop product line for 2022. This is why receipts are always important!įor more details on QuickBooks Bank Feeds for QuickBooks online, read this article.įor more information on updates to Bank Feeds in QuickBooks Desktop, check out this article. Similarly, some transactions provide imprecise data, such as in cases where the memo is “POS Purchase,” but provides no details on the vendor. It is up to you to ensure that the proper account is selected.

#IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT DOWNLOAD#

Whenever you download transactions for USPS, it will automatically log to “Shipping & Freight” regardless of the purpose of the transaction. Say you set up a rule that whenever your bank statement sees “USPS” you set it to log to “Shipping & Freight,” an existing account in your chart of accounts. Others issues arise because bank feeds create rules for certain transactions.

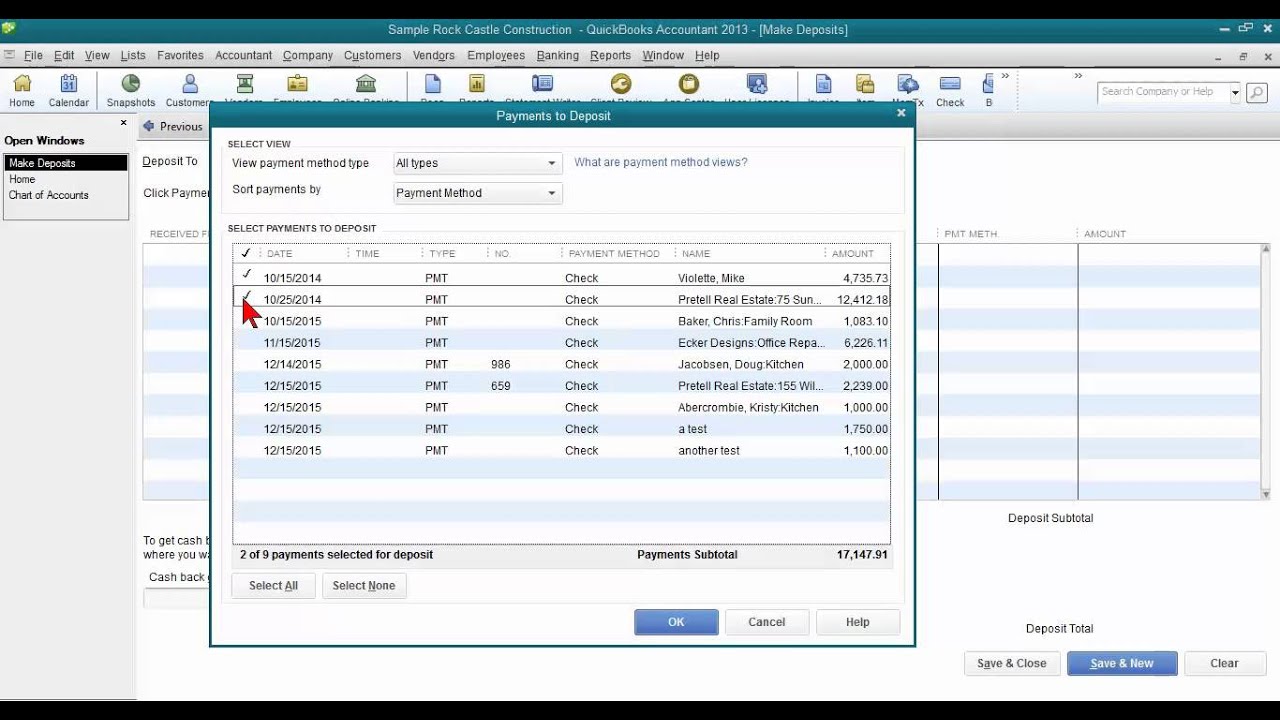

In the online version, there is a function to match the downloaded transaction with existing payments. This is why you cannot use downloaded transaction as a way to enter deposits, rather you can only use it to match existing deposits. Your imported deposits will not match anything in QuickBooks unless you already have deposited funds. The $7,500 deposit you added is not connected to the $7,500 you have sitting in undeposited funds. If you import a deposit of say, $7,500, and add it into QuickBooks, you may be ignoring the fact that you may have already received funds of that same amount. One major issue with bank feeds is that for the desktop version is that some users are incorrectly entering deposits using the imported data. When done properly, it can help you balance your checking account or credit card as you go. Once set up, the bank feeds will help you double check your transactions and automate the coding process. I have used it before and it works, but it does force you to connect with a fake account number.

#IN QUICKBOOKS FOR MAC MATCH MULTIPLE DEPOSITS WITH ONE DEPOSIT SOFTWARE#

Software from Propersoft seems to be the most popular and affordable. If you happen to have one of those banks that do not support the importing of data into QuickBooks, then there are a few. Many clients find this to be a quicker way to import their accounting data as the QuickBooks browser can be slow and clunky. If QuickBooks is open, all you have to do is double click on the file. QBO files, you can manually log into your bank account from your browser to retrieve the file. Note that these transactions are NOT in your General Ledger until you add them into QuickBooks.ģ) For banks that do allow for a direct connect, but do offer.

QBO file or set up the bank feed, you can automatically download transactions into your QuickBooks file. Some banks will allow you to login directly through QuickBooks’ browser.Ģ) Once you import your. Not all banks will allow for direct connect with QuickBooks, so many will require that you manually download a bank statement that is in the. To import data into QuickBooks Desktop (the online version has a slightly different process), you’ll first have to check that your bank participates with Intuit.ġ) Go to Banking>Bank Feeds> Set up Bank Feeds and enter the name of your bank. However, this feature can cause some issues depending on how you use the function. It saves business owners the amount of time it would take them to enter a date and an amount for each transaction. One of the selling points for the newer versions of QuickBooks and QuickBooks online is the ability to connect directly with your bank account and download transaction data.

0 kommentar(er)

0 kommentar(er)